Credit Card Merchant Services Comparison

Merchant services involves numerous different companies, banks, hardware and software, so inevitably this causes confusion and frustration to businesses. This article outlines the process involved to give you a better understanding when choosing the most appropriate solution for installing a service for the first time or upgrading your existing service.

The main question we get asked is “Should I go for a hire agreement (contract) or buy a mobile machine without a contract”?

To narrow down the answer, we would ask you these 5 questions:

- What’s your annual merchant turnover?

- What’s your predicted turn over in the next 2-3 years?

- What is your average transaction value (ATV)?

- What’s the age of business?

- What’s the credit history of the business?

When to buy

This is geared to smaller retail outlets, mobile traders or start-ups. Sum up, iZettle , Square and Paypal are among the most popular mobile merchant machines. With them, there is a relatively low up-front cost of around £20 – £30 with no ongoing contract costs, though the transaction rates (the amount you are charged to process each transaction) are higher than traditional contract agreements.

There are obvious pros and cons for each of the providers and your personal preference will depend on your priorities. Look for customer service, speed your revenue reaches your account, transaction rates and the terms surrounding fraud prevention, charge backs, ability to offer cash back or include gratuities.

When to hire

This is an arrangement through the major acquiring bank and involves no or minimal up-front costs, but does incur a monthly contract fee, compliance fees, authorisation charges, statement fees, though they do have lower card transaction rates.

The best solution for you

With the two broad options available, the decision will undoubtably come down to the cost to your business of taking card payments.

As general rule of thumb, if your turnover is under £80k per year, a bought machine with Sumup or iZettle etc would be most suitable. If your turnover increases above £80k per annum, you will need to start analysing the card types and comparing them to a fixed fee.

When looking at the differences between the two options, price is a very important aspect, however the complexities of arranging a merchant contract are vast, and can be very time consuming. By buying an off the shelf solution, you can be set up in a day or two.

The main merchant banks are Elavon, Worldpay, Barclays, Global Payments and First Data. The pros and cons are equally similar to those of the off the shelf mobile options, but as well as the costs, customer service should be considered.

Transaction rates

An analysis of card types used is also essential to ascertain what type of solution would be best placed for your business. If you buy a mobile device and pay for a standardised rate on all transactions, there will be no effect on the cost to your business when accepting credit cards over debit cards or corporate cards.

However, if you sign a contract, the rates charged will vary greatly depending on the card types used. Generally, we can negotiate personal debit card rates of 0.4% of each transaction, whereas a credit card would be double at around 0.8%, and corporate credit cards are over 4 times higher nearer 2%.

How to compare merchant services

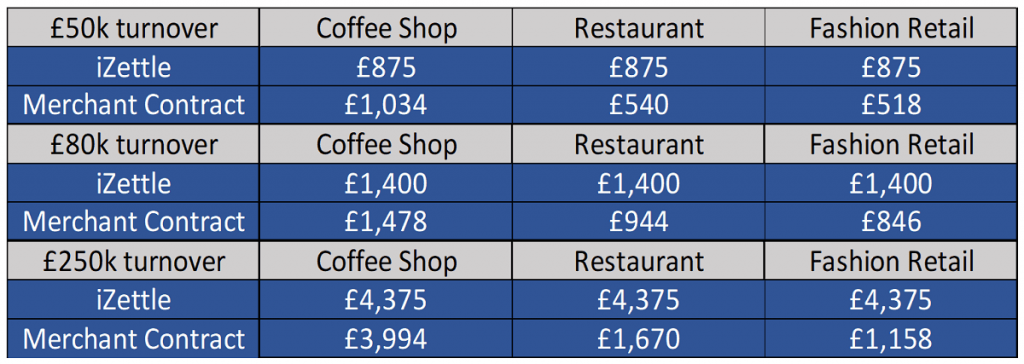

Below is an analysis of 3 company types that have an annual revenue of £50k, £80k and £250k pa. They have been modelled on a:

- Coffee shop, with numerous transactions using predominantly debit cards of low amounts (Average Transaction Value £5).

- Restaurant, lower volume of transactions, but higher values (ATV £35).

- Fashion retail shop, taking even fewer transactions but of higher values (ATV £50).

iZettle or merchant contract?

The table above, clearly shows where the benefits of iZettle (or other mobile device) are and where a full contract would be beneficial. For the businesses with high Average Transaction Values (above £10), a full contract would be the cheapest option, even with a low annual turnover.

Looking at the fashion retail example, if turnover was £250k pa, a mobile iZettle device would cost nearly 4 times a merchant contract.

On the flip side, the coffee shop with £50k turnover would benefit from an iZettle solution. Even at £80k pa, it’s pretty equal as to which is most suitable, so when revenue exceed this, the margin of difference increases.

Merchant contracts are heavily regulated and an extensive amount of due diligence is performed, meaning that if your credit is poor, a start-up, or your type of business is considered high risk, you may not be accepted by an acquiring or merchant bank. You will have no other option but to buy the equipment with no contract until you have improved your credit score and have revenue history.

If we want to go ahead, what’s next?

With such heavy due diligence and regulations, there is a lot of ID, information and proof of address required – there’s no avoiding it! Our team will guide you through the requirements and complete the application for you. We will be able to prevent timely mistakes and ensure a smooth process.

When the application process is complete, the terminals will be sent to your business address. Full support will be available throughout and we will ensure you are set up properly, and your questions answered.

Why use Meercat?

Not only can we help you make the best decision for your merchant services via our National Buying Group, we also have a team of experts to:

- Give you the most competitive rates on the market.

- Guide you through the decision-making process.

- Provide you with the software and hardware products, including online gateways and full Point Of Sale (POS) systems.

- Guide you with the onboarding process, including a mountain of paperwork so you can concentrate on increasing that revenue stream!

We provide full on-going support and should your requirements change during the contract period, we can co-ordinate with the merchant banks on your behalf to move with the demands of your business.

We cannot break contractual terms, but our relationships allow us to discuss and remedy situations quicker and more effectively than individual businesses can by speaking directly to them.What do you need to analyse our position?

We just need a statement from your current merchant supplier, or if you are new to merchant services, a forecast of income and anticipated card types and ATVs.

With this information, our analysts will review the market and provide a savings comparison report. This valuable information will allow you to see where the costs are in your current merchant contract and allow us to assess efficiencies and the most suitable product for you.

All of this is free of charge and with no obligation required on your part. Call us on 01444 416529 to discuss.